Collectibles Insurance: Protect Your Valuables Today

Collectibles Insurance is a type of insurance that provides coverage for rare or valuable items like stamps, coins, artwork, or antiques. It offers protection to individuals who own collectibles against damage, loss, or theft.

As an avid collector, it can be challenging to find reliable insurance coverage for your precious items. Without adequate insurance, the loss or damage of your collectibles could be devastating, both personally and financially. Collectibles insurance offers a solution by providing coverage for your beloved items.

However, with so many insurance providers out there, it can be daunting to find the right one that suits your needs. We will explore Collectibles Insurance in more detail, what it covers, how much it costs, and how to purchase a policy.

What Is Collectibles Insurance?

Collectibles Insurance is a specialized type of insurance that provides coverage for rare and valuable items such as antiques, artwork, coins, and stamps. The insurance offers protection from losses, theft, and damages, providing a financial safety net for collectors. Find reliable and flexible coverage options from leading providers like Collect Insure, Chubb, and American Collectors Insurance.

Definition

Collectibles insurance is a specific type of insurance coverage designed to protect rare or valuable items from damage, theft, and loss. It’s ideal for those who possess high-value items, such as stamps, coins, antiques, artwork, sports memorabilia, or vintage guns. The insurance policy provides coverage that is tailored to the specific requirements of each customer’s needs.

Types Of Collectibles Covered

Collectibles insurance covers a broad range of items, and it’s critical to ensure that your specific collectibles are included in the policy before purchasing it. Some of the common types of collectibles that are often covered under such insurance policies are:

| Types of Collectibles | Examples |

|---|---|

| Coins and Stamps | Old and rare coins, foreign currencies, unique stamps, classic banknotes, etc. |

| Artwork | Paintings, sculptures, pottery, glassware, tapestries, etc. |

| Antiques | Furniture, jewelry, vintage clothing, rugs, and historic objects, etc. |

| Sports Memorabilia | Autographed jerseys, baseball cards, signed footballs, game programs, and souvenirs, etc. |

| Vintage Guns | Antique firearms, swords, medals, and military memorabilia, etc. |

These are just a few examples of what collectibles insurance typically covers. However, you should always check with your insurer to see whether your specific items are covered.

Importance Of Collectibles Insurance

Collectibles insurance is critical to safeguarding the things that you value most in life. Without proper coverage, these items could be lost or damaged, and they may never be able to be replaced. Moreover, most standard homeowner’s or renter’s insurance policies have a limit on the coverage they provide and may not cover your collection’s full value.

So, it’s best to get collectibles insurance for the peace of mind that comes with knowing that your treasured possessions are secure and protected.

Why Do You Need Collectibles Insurance?

Collectibles insurance is a type of insurance that provides coverage specifically tailored for rare or valuable items, such as antiques, sports memorabilia, jewelry, and artwork. Collectibles are special items that hold significant sentimental and financial value for the owner, making them irreplaceable. By getting collectibles insurance, you’ll have peace of mind knowing that your prized collection is secure and protected.

Risks Of Not Insuring

Not getting collectibles insurance is a risky decision that leaves you vulnerable to various perils. Here are a few risks of not insuring your collectibles:

- Theft: Collectibles are often targeted by thieves since they have high resale value. Without coverage, you may have to bear the loss entirely.

- Fire or natural disasters: Natural disasters like floods, hurricanes, and earthquakes can occur without warning and wreak havoc on your home and collectibles. Collectibles insurance can help you recover financially from such catastrophes.

- Accidental damage: Unfortunately, accidents can happen, and your collectibles can be damaged or destroyed. Without insurance, you may not be able to replace or repair them.

Benefits Of Having Insurance

Getting collectibles insurance brings many benefits, including:

- Financial protection: Collectibles insurance can protect you from financial loss due to theft, damage, or loss of your valuable items. This coverage can reimburse you the full value or replace the items, depending on the policy.

- Peace of mind: By getting insurance, you can relax knowing that your collectibles are protected, and you can focus on other things.

- Potential savings: While the cost of insurance varies depending on the policy, collectors can often get savings by bundling their collectibles with other insurance policies, such as homeowner’s insurance.

Choosing The Right Collectibles Insurance

Protecting your valuable collectibles is essential, and choosing the right insurance is crucial. Collectibles insurance specifically covers rare and valuable items, such as stamps, coins, antiques, and more. Companies like Collectibles Insurance Services and American Collectors Insurance offer comprehensive coverage options to meet your unique needs.

When it comes to insuring collectibles, finding the right policy can be harder than expected. Not all insurance providers are created equal, and it’s important to choose one that offers adequate coverage for the specific type of collectible and its value. Here are some important factors to consider when choosing the right collectibles insurance.

Factors To Consider

- Valuation: Before insuring collectibles, it’s important to have them appraised by a professional to determine their value. This value will be used to determine the insurance premium and the amount of coverage needed.

- Coverage: Different collectibles may require different types of coverage. For example, while some policies may cover damage and loss, others may not cover damage by natural disasters or other unexpected events.

- Deductibles: Like most types of insurance, collectibles insurance has deductibles. It’s important to choose a deductible that is affordable and reasonable.

- Claims: In the event of a claim, the insurance provider should have a streamlined and efficient process in place. Choose a provider with a good reputation for handling claims in a timely and fair manner.

- Customer service: Choose a provider with top-notch customer service. This ensures that all of your questions are answered promptly, and any issues that arise are handled efficiently.

Comparing Different Policies

Comparing different collectibles insurance policies is crucial to ensuring that you choose the one that is best for your specific needs. Here are some key aspects to look for when comparing policies:

| Aspect | What to Look for |

|---|---|

| Coverage | Ensure that the policy covers the specific type of collectible and any other damages or losses that may occur. |

| Cost | Compare premiums and deductibles to make sure that the policy fits within your budget. |

| Terms and conditions | Read through the policy thoroughly to understand the terms and conditions, including any exclusions or limitations. |

| Reviews and ratings | Research the insurance provider’s reputation by reading customer reviews and ratings to ensure that they have a good track record. |

Ensuring that you choose the right collectibles insurance policy may take time, but the peace of mind it provides is worth the effort. By considering the factors outlined above and comparing different policies, you’ll be well on your way to finding the best coverage for your treasured collection.

Tips For Protecting Collectibles

Protecting your valuable collectibles is important, which is why obtaining collectibles insurance is crucial. From stamps to artwork to antiques, collectibles insurance offers unique coverage to protect against loss or damage. It’s always best to do your research and find a reputable insurance provider that fits your needs and budget.

Collectibles can be valuable and meaningful, making it important to take appropriate measures to protect them. That’s why it’s essential to consider collecting insurance, which can cover loss or damage to your collectibles. However, there are other ways to protect your prized possessions. Below are some tips for protecting your collectibles.

Storage And Handling

One of the primary ways to protect your collectibles is to ensure that they are stored properly. Here are some tips to keep in mind:

- Store items in a dry, cool place free from moisture, temperature fluctuations, and UV light exposure.

- Use acid-free and archival-quality materials such as boxes, sleeves, and folders when storing paper-based collectibles like comics, trading cards, and stamps.

- Use silicone gel packs to absorb moisture and prevent damage from any condensation.

- Handle items with clean and dry hands or wear gloves to prevent any physical damage or oil residue.

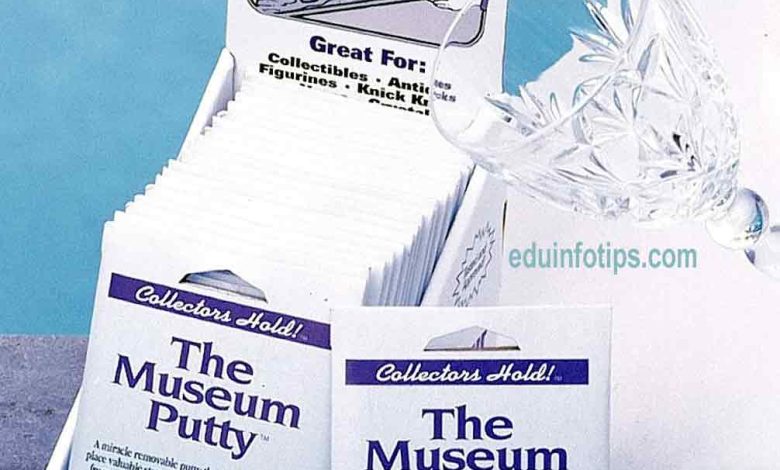

- Use protective covers to guard against scratches or other potential damages to brittle or delicate items like glass, ceramics, and statues.

Displaying Your Collection

Displaying your collectibles can be a great way to showcase them, but it can also pose some risks. Here are some tips to keep in mind when displaying your collectibles:

- Display items away from direct sunlight, heat sources, and moisture.

- Ensure that collectibles are placed on sturdy, stable surfaces to avoid accidental falls or damage.

- Use proper lighting to enhance your collection, but take care to avoid any UV light exposure.

- Ensure that shelves and cabinets are securely mounted to walls, and heavier items are kept on lower shelves.

- Consider having alarm systems installed to deter any potential theft or break-ins.

By following these tips, you can protect your collectibles from damage, loss, or theft. Additionally, consider insuring your collection with a reliable insurance provider like Collectibles Insurance Services or Chubb for added peace of mind and protection.

Cost Of Collectibles Insurance

Collectibles insurance offers coverage specifically for rare or valuable items such as stamps, coins, artwork, or antiques. The cost of collectibles insurance varies depending on the item insured, its value, and the level of coverage required. It is important to insure your collectibles to protect them against loss or damage.

Factors Affecting Cost

The cost of collectibles insurance can vary depending on several factors. The item’s value is one of the primary factors that affect the cost of insurance. The higher the value of an item, the higher the insurance premium. The item’s rarity, age, condition, and material also affect the cost of insurance.

The location and type of storage where the item is kept, for example in a climate-controlled vault or a regular storage space, also play a role in determining the cost of insurance.

How To Save On Premiums

While the cost of collectibles insurance can seem steep, there are ways to save on premiums. The first step to reducing the cost of insurance is by having a professional appraisal of the item’s value. This enables you to ensure you are paying the correct premium for the value of the item and avoid overpaying.

Additionally, maintaining proper security measures such as an alarm system and fireproof safe can also help lower insurance premiums. Bundling insurances or selecting higher deductibles can help reduce costs.

Conclusion:

Investing in collectibles is an exciting experience, but it comes with the responsibility of protecting them. Collectibles insurance can safeguard collectors from unforeseeable events that could damage or destroy their collections. While the cost of insurance may seem expensive, it is a small price to pay for the peace of mind that comes with knowing your investment is protected.

Don’t hesitate to get a collectibles insurance policy and protect your cherished treasures today.

Top Companies For Collectibles Insurance

For those looking to insure their valuable collectibles, there are several top companies to consider. Collectibles Insurance Services offers coverage for vintage guns and sports cards, while Chubb and American Collectors Insurance cover a wide range of collections including wine, stamps, and comic books.

If you are an avid collector, then protecting your prized possessions should be a top priority. Collectibles insurance gives you peace of mind that your collection is safe and secure, and if anything was to happen, you would be covered. But with so many insurance companies out there, it can be challenging to find the right one for you.

In this article, we will provide you with some of the top companies for collectibles insurance, including American Collectors Insurance, Chubb, and Allstate.

American Collectors Insurance

American Collectors Insurance is a company that specializes in providing insurance for collectors of all kinds, including classic cars, motorcycles, and collectibles. They offer various types of coverage, including agreed value, flexible usage, and no-deductible options. With American Collectors Insurance, you can tailor your policy to fit your specific needs, which means you only pay for what you need.

Chubb

Chubb is another company that provides collectibles insurance. They offer worldwide coverage and can protect your collection against damage, loss, or theft. Their coverage options include automatic coverage for new items, no deductibles, and flexible coverage limits, which means you can insure your collection at its full value.

Allstate

Allstate is a well-known insurance company that offers a wide range of insurance products, including collectibles insurance. Their policies cover various types of collections, including sports memorabilia, fine art, comics, and more. Allstate’s collectibles insurance provides coverage for accidental breakage, fire, theft, and other types of damage.

They also offer flexible coverage limits, which means you can tailor your policy to meet your specific needs. Overall, when it comes to collectibles insurance, it’s essential to choose a company that specializes in this area and understands the value of your collection. By choosing one of these top companies, you can give yourself peace of mind that your collection will be well-protected.

How To Insure Specific Types Of Collectibles

Protecting your valuable collectibles like stamps, artwork, coins, and antiques is crucial through collectibles insurance. With this insurance, you can cover most collectible losses with no deduction and can enjoy worldwide coverage options to meet your unique needs. Consider investing in collectibles insurance to safeguard your prized possessions.

If you own rare or valuable collectibles, it’s important to insure them to protect your investment. But how do you insure specific types of items? Here’s how to insure three common types of collectibles:

Fine Art

Insuring fine art involves several steps. First, you need to have your collection appraised by a reputable art appraiser. This appraisal will be used to determine the value of your collection and set your insurance rates. Next, you’ll need to find an insurer that specializes in art insurance. Make sure you read the policy carefully to understand what is covered and what is not. Finally, document your collection with photographs, descriptions, and purchase receipts.

Sports Memorabilia

To insure your sports memorabilia collection, you’ll need to have it appraised by a professional sports memorabilia appraiser. This will determine the value of your collection for insurance purposes. Then, you’ll need to find an insurance company that specializes in sports memorabilia insurance. Make sure you read the policy carefully and ask plenty of questions to ensure you have the right coverage. Finally, keep your collection in a safe, secure location to prevent damage or theft.

Wine

Insuring a wine collection is crucial for ensuring its safety and security. First, have your collection appraised by a professional wine appraiser. This will determine the value of your collection for insurance purposes. Then, find an insurer that specializes in wine collection insurance. Keep in mind that coverage may vary depending on whether your wine is stored in a personal cellar or a professional wine storage facility.

Finally, keep detailed records of your collection, including purchase receipts, appraisals, and insurance documents. No matter what type of collectibles you own, it’s essential to insure them properly to protect your investment. Follow these steps to ensure your collection is covered in case of damage, loss, or theft.

Frequently Asked Questions For Collectibles Insurance

Can You Get Insurance On Collectibles?

Yes, you can get insurance on collectibles. Collectibles insurance is a type of insurance that specifically covers rare or valuable items, such as stamps, coins, artwork, or antiques. There are many insurance providers that offer collectibles insurance services, including Chubb, American Collectors Insurance, and Allstate.

The cost of insurance varies depending on the value of the collectible and the coverage needed.

What Is Collectible Insurance?

Collectible insurance is a type of insurance that provides coverage for valuable and rare items such as coins, stamps, artwork, and antiques. It is designed to protect collectibles from damage, theft, or loss. With collectible insurance, one can insure their collections and enjoy peace of mind knowing that their valuable items are protected.

How Much Does It Cost To Insure Collectibles?

The cost of insuring collectibles varies based on the value of the item and the level of coverage desired. It’s best to get a quote from a reliable insurance agency that specializes in collectibles insurance to determine the exact cost.

How Do You Protect Collectibles?

In order to protect collectibles, you should consider insuring them with a collectibles insurance service. These services offer coverage specifically for rare or valuable items such as stamps, coins, artwork, or antiques. Additionally, it’s important to store your collectibles properly by using protective cases or displays, keeping them out of direct sunlight and extreme temperatures, and handling them with care.

Regular cleaning and maintenance can also help preserve their condition.

Conclusion

Whether it’s a rare coin or a prized artwork, collectibles insurance can provide the needed protection for your valuable possessions. With numerous insurers offering flexible worldwide coverage options, you can find a policy that suits your specific needs and budget.

Don’t take chances with your collectibles – get the right insurance coverage today.